December 11, 2023You are cordially invited to attend the meeting online. Whether or not you expect to attend the meeting, please vote by proxy over the telephone or through the internet, or by completing, dating, signing and returning the enclosed proxy as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote online if you attend the meeting. Please note, however, that if your shares are held through a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. TABLE OF CONTENTS

EIGER BIOPHARMACEUTICALS, INC.

FOR THE 2022 ANNUALSPECIAL MEETING OF STOCKHOLDERS QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive

TO BE HELD ON DECEMBER 28, 2023 This proxy statement is furnished to stockholders of Eiger BioPharmaceuticals, Inc., a notice regardingDelaware corporation (the “Company,” “we,” “our” or “us”), in connection with the availabilitysolicitation of proxy materials on the internet?Pursuant to rules adoptedproxies by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because our Board of Directors (our “Board”) for use at a special meeting of stockholders to be held on December 28, 2023, and at any adjournment or postponement thereof (our “Special Meeting”). Our Special Meeting will be held at 9:00 a.m. Pacific Time via a live webcast at www.virtualshareholdermeeting.com/EIGR2023SM.

On or about December 11, 2023, we will commence mailing of the proxy materials which are also available at www.proxyvote.com. The proxy materials are being sent to stockholders who owned our common stock at the close of business on November 20, 2023, the record date for the Special Meeting (the “Board”“record date”). This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully. Why am I receiving these materials? We sent you this proxy statement because our Board is soliciting your proxy to vote at our Special Meeting. This proxy statement summarizes the 2022 Annual Meeting of Stockholders (the “Annual Meeting”), including any votes related to adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice. In this Proxy Statement, “we,” “us,” “our” and “Eiger” refer to Eiger BioPharmaceuticals, Inc.We intend to mail the Notice on or about April 28, 2022 to all stockholders of record entitledinformation you need to vote at our Special Meeting. You do not need to attend our Special Meeting to vote your shares.

What proposals will be voted on at our Special Meeting? Stockholders will vote on two proposals at our Special Meeting: 1.

| The approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of Company common stock (without reducing the authorized number of shares of Company common stock), if and when determined by the Company’s board of directors (the “Amendment Proposal”); and |

2.

| The approval of the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes in favor of the amendment to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split (the “Adjournment Proposal”). |

The Board knows of no other matters that will be presented for consideration at the AnnualSpecial Meeting. Will I receive If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy materials by mail?

We may send you a proxy card, alongto vote on those matters in accordance with a second Notice, after May 9, 2022.

their best judgment. How do I attend the AnnualSpecial Meeting? You are entitled to attend the Annual Meeting if you were a stockholder as of the close of business on April 19, 2022, the record date, or hold a valid proxy for the meeting.

To be admitted to the AnnualSpecial Meeting, you will need to visit www.virtualshareholdermeeting.com/ EIGR2022EIGR2023SM and enter the 16-digit Control Number control number found next to the label “Control Number” on your Noticeproxy card or proxy card.voting instruction form. If you are a beneficial stockholder, you should contact the bank, broker or other institution where you hold your account well in advance of the meeting if you have questions about obtaining your control number/proxy to vote. Whether or not you participate in the Annual Meeting, it is important that you vote your shares.

WHETHER OR NOT YOU PARTICIPATE IN THE SPECIAL MEETING, IT IS IMPORTANT THAT YOU VOTE YOUR SHARES. We encourage you to access the AnnualSpecial Meeting before it begins. Online check-in will start approximately 15 minutes before the meeting on Thursday, June 16, 2022.December 28, 2023. TABLE OF CONTENTS Who can vote

Can I ask questions during the Special Meeting? Stockholders will have the ability to submit questions during the Special Meeting via the Special Meeting website at www.virtualshareholdermeeting.com/EIGR2023SM. Questions may be submitted online shortly prior to, and during, the Special Meeting by logging in with the 16-digit control number at www.virtualshareholdermeeting.com/EIGR2023SM. We will answer questions during the Special Meeting that are pertinent to the proposals presented at the Annual Meeting?OnlySpecial Meeting. If we receive substantially similar written questions, we plan to group such questions together and provide a single response to avoid repetition and allow time for additional question topics. For appropriate questions that are not otherwise addressed during the Special Meeting, we will publish our responses on our Investor Relations site after the meeting or communicate the relevant response directly to the submitting stockholder. Additional information regarding the rules and procedures for participating in the virtual Special Meeting will be provided in our rules of conduct for the Special Meeting, which stockholders ofcan view during the meeting at the meeting website.

What happens if there are technical difficulties at the Special Meeting We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Special Meeting, voting at the Special Meeting or submitting questions at the Special Meeting. If you encounter any difficulties accessing the virtual Special Meeting during the check-in or meeting time, please call the technical support number that will be posted on www.virtualshareholdermeeting.com/EIGR2023SM. How does our Board recommend that stockholders vote on the proposals? Our Board recommends that stockholders vote “FOR” the Amendment Proposal and “FOR” the Adjournment Proposal. Who is entitled to vote? The record atdate for our Special Meeting is the close of business on April 19, 2022 will be entitled to vote atNovember 20, 2023 (the “record date”). As of the Annual Meeting. On this record date, there were 43,216,12644,384,684 shares of our common stock outstanding and entitled to vote. vote at the Special Meeting. Holders of record of our common stock as of the record date will be entitled to notice of and to vote on the Amendment Proposal and the Adjournment Proposal at our Special Meeting or any adjournment or postponement thereof. A list of stockholders entitled to vote at the AnnualSpecial Meeting will be available for examination during normal business hours for ten days before the AnnualSpecial Meeting at our address above. To the extent office access is impracticable due to the ongoing COVID-19 pandemic,an unexpected health crisis, you may send a written request to the Corporate Secretary at our corporate headquarters, and we will arrange a way for you to inspect the list.

Stockholder of Record: Shares Registered in Your Name If on April 19, 2022November 20, 2023 your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote 1

online at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy over the telephone, on the internet as instructed below or by proxy using a proxy card that you may request or that we may elect to deliver at a later time to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank If on April 19, 2022November 20, 2023 your shares were held not in your name but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice isproxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the AnnualSpecial Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the AnnualSpecial Meeting. However, since you are not the stockholder of record, you may not vote your shares virtually at the meeting unless you request and obtain a valid proxy from your broker or other agent. What am I voting on?

There are three matters scheduled for a vote:

TABLE OF CONTENTS Election of three Class I directors to hold office until the 2025 Annual Meeting of Stockholders;

Advisory approval of the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement in accordance with SEC rules; and

Ratification of selection by the Audit Committee of the Board of Directors of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote? You may either vote “For” the nominees to the Board of Directors or you may “Withhold” your vote for the nominees. For each of the other matters to be voted on, you may vote “For,” “Against” or abstain from voting.

The procedures for voting are as follows:

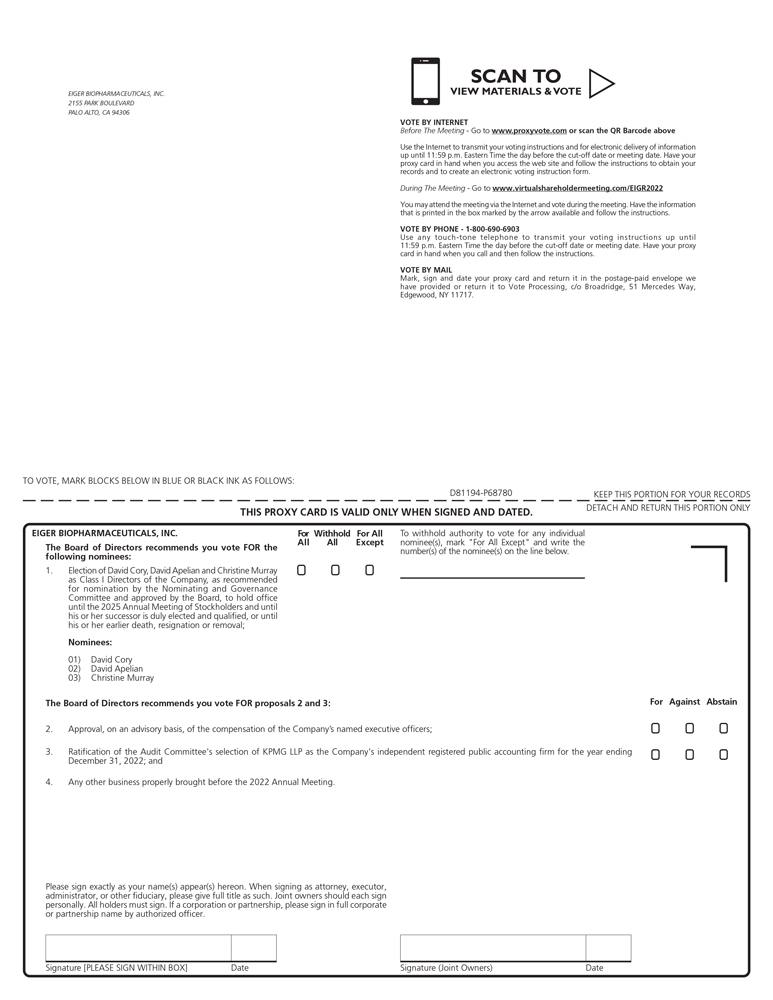

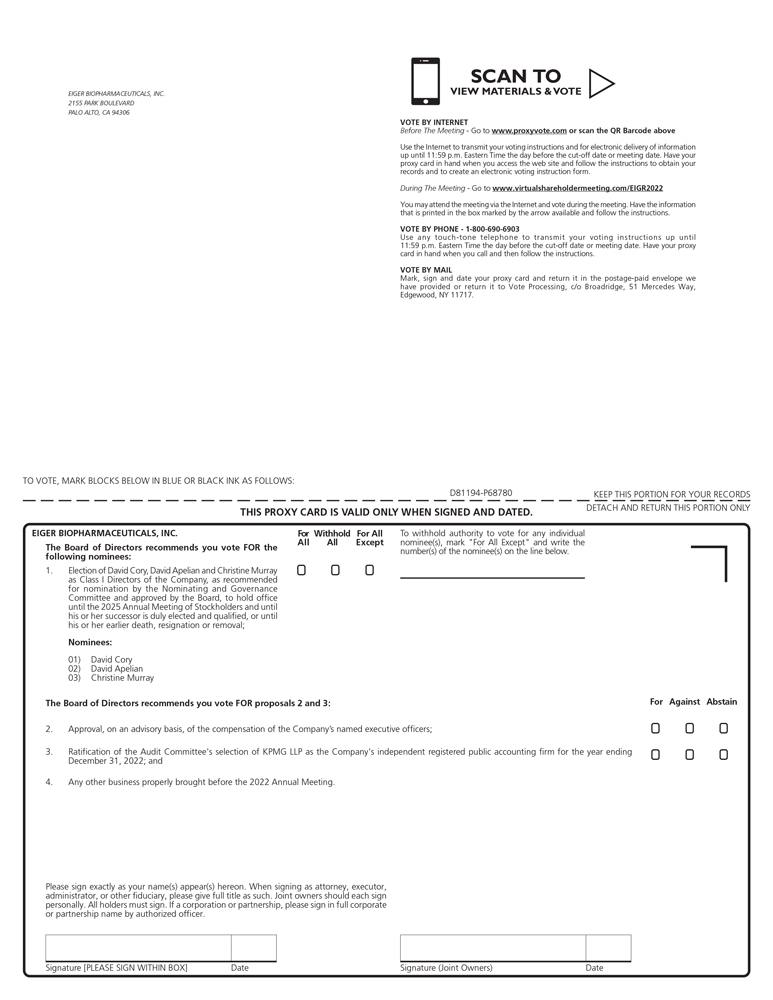

Stockholder of Record: Shares Registered in Your Name If you are a stockholder of record, you may vote online at the AnnualSpecial Meeting, vote by proxy over the telephone, vote by proxy through the internet or vote by proxy by mail using athe enclosed proxy card that you may request and that we may elect to deliver at a later time.card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote online even if you have already voted by proxy. To vote during the AnnualSpecial Meeting, if you are a stockholder of record as of the record date, follow the instructions at www.virtualshareholdermeeting.com/EIGR2022.EIGR2023SM. You will need to enter the 16-digit Control Number control number found on your Noticeproxy card or in the email sending you the Proxy Statement. voting instruction form.To vote using the proxy card that may be delivered to you, simply complete, sign and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the AnnualSpecial Meeting, we will vote your shares as you direct. 2

To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice.your proxy card or voting instruction form. Your telephone vote must be received by 11:59 p.m., Eastern Time on June 15, 2022December 27, 2023 to be counted. To vote through the internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice.proxy card or voting instruction form. Your internet vote must be received by 11:59 p.m. Eastern Time on June 15, 2022December 27, 2023 to be counted. Beneficial Owner: Shares Registered in the Name of Broker or Bank If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Noticefull set of proxy materials containing voting instructions from that organization rather than from Eiger. Simply follow the voting instructions in the Noticeproxy materials to ensure that your vote is counted. To vote online at the AnnualSpecial Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form. How many votes do I have? On each matter to be voted upon, you have one vote for each share of common stock you own as of April 19, 2022.November 20, 2023. What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name If you are a stockholder of record and do not vote by completing your proxy card, by mail, by telephone, through the internet or online at the AnnualSpecial Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. In this regard, under the rules of the New York Stock Exchange (NYSE), brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules,, but not with respect to “non-routine”“non-routine” matters. Proposals 1One and 2Two are considered to be “non-routine” under NYSE rules, meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 3 is considered a “routine” matter under NYSE rules,matters, meaning that if you do not return voting instructions to your broker before its deadline, your shares may be voted by your broker in its discretion on Proposal 3.Proposals One and Two. What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For”“FOR” the election ofAmendment Proposal and “FOR” the nominees for director; “For” the advisory approval of named executive officer compensation and “For” the ratification of the selection by the Audit Committee of the Board of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.Adjournment Proposal. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment. TABLE OF CONTENTS Who is paying for this proxy solicitation? We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. 3

What does it mean if I receive more than one Notice? full set of proxy materials? If you receive more than one Notice,full set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each of the Noticesproxy cards or voting instruction forms to ensure that all of your shares are voted. Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways: You may submit another properly completed proxy card with a later date. You may grant a subsequent proxy by telephone or through the internet. You may send a timely written notice that you are revoking your proxy to Eiger’s Corporate Secretary at 2155 Park Blvd., Palo Alto, California 94306. You may attend the AnnualSpecial Meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy. Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank. When

How are votes counted? Votes will be counted by the inspector of election appointed for the meeting, who will separately count each proposal as follows: Proposal One, the Amendment Proposal, must receive FOR votes from the holders of a majority of votes cast on the proposal. Abstentions with respect to the Amendment Proposal will not be considered “votes cast” and so will have no effect on the proposal. Brokers will have discretionary authority to vote on this proposal. Accordingly, there will not be any broker non-votes on this proposal. Proposal Two, the Adjournment Proposal, must receive FOR votes from the holders of a majority in voting power of the shares of our common stock present or represented by proxy at the Special Meeting and entitled to vote on such proposal. An abstention on Proposal Two will have the same effect as a vote “AGAINST” Proposal Two. Brokers will have discretionary authority to vote on this proposal. Accordingly, there will not be any broker non-votes on the Adjournment Proposal. What are “broker non-votes”? As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by applicable stock exchange rules to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.” TABLE OF CONTENTS How many votes are needed to approve each proposal? The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes. 1 | | | Amendment Proposal | | | “FOR” votes from the holders of a majority of votes cast on the proposal | | | No effect | | | Not applicable(1) | 2 | | | Adjournment Proposal | | | “FOR” votes from the holders of a majority of shares present virtually or represented by proxy and entitled to vote on the matter | | | Against | | | Not applicable(1) |

(1)

| The Company believes that this proposal is considered to be a “routine” matter. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority to vote your shares on this proposal. |

What is the quorum requirement? A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares of stock entitled to vote are present at the meeting virtually or represented by proxy. On the record date, there were 44,384,684 shares outstanding and entitled to vote. Thus, the holders of 22,192,343 shares must be present virtually or represented by proxy at the meeting to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting virtually or represented by proxy may adjourn the meeting to another date. How can I find out the results of the voting at the Special Meeting? Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results. What proxy materials are available on the internet? The Proxy Statement, Form 10-K and Annual Report to stockholders are available at www.proxyvote.com. All references to “Eiger,” “we,” “us” or “our” in this Proxy Statement mean Eiger BioPharmaceuticals, Inc. TABLE OF CONTENTS APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK (WITHOUT REDUCING THE AUTHORIZED NUMBER OF SHARES OF OUR COMMON STOCK), IF AND WHEN DETERMINED BY OUR BOARD Overview The Amendment Proposal is a proposal to adopt an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split at a ratio between one-for-ten (1:10) and one-for-thirty-five (1:35)], inclusive (the “Split Ratio Range”), in the form set forth in Exhibit A to this proxy statement. The Amendment Proposal, if approved, would not immediately cause a reverse stock split, but rather would grant authorization to our Board to effect the reverse stock split (without reducing the number of authorized shares of our common stock) with a split ratio within the Split Ratio Range, if and when determined by our Board. Our Board has deemed it advisable, approved and recommended that our stockholders adopt and is hereby soliciting stockholder approval of the proposed amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split at a ratio within the Split Ratio Range, in the form set forth in Exhibit A to this proxy statement. If we receive the required stockholder approval, our Board will have the sole authority to elect, at any time prior to the 2024 Annual Meeting of Stockholders, whether or not to effect a reverse stock split. Even with stockholder approval of the Amendment Proposal, our Board will not be obligated to pursue the reverse stock split. Rather, our Board will have the flexibility to decide whether or not a reverse stock split (and at what ratio within the Split Ratio Range) is in the best interests of the Company and its stockholders. If approved by our stockholders and following such approval our Board determines that effecting a reverse stock split is in the best interests of the Company and our stockholders, the reverse stock split would become effective upon filing a certificate of amendment to our Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware. As filed, the certificate of amendment would state the number of outstanding shares to be combined into one share of our common stock, at the ratio approved by our Board within the Split Ratio Range. The amendment would not change the par value of our common stock and would not impact the total number of authorized shares of our common stock. Therefore, upon effectiveness of a reverse stock split, the number of shares of our common stock that are authorized and unissued will increase relative to the number of issued and outstanding shares of our common stock. Although we presently intend to effect the reverse stock split to regain compliance with the Nasdaq Global Market’s minimum bid price requirement, under Section 242(c) of the Delaware General Corporation Law, our Board has reserved the right, notwithstanding our stockholders’ approval of the proposed amendment of the Amended and Restated Certificate of Incorporation at the Special Meeting, to abandon the proposed amendment at any time (without further action by our stockholders) before the certificate of amendment with respect thereto is filed with the Secretary of State of the State of Delaware. Our Board may consider a variety of factors in determining whether or not to proceed with the proposed amendment of the Amended and Restated Certificate of Incorporation and the appropriate range within the Split Ratio Range for any such amendment, including overall trends in the stock market, recent changes and anticipated trends in the per-share market price of our common stock, business developments and our actual and projected financial performance. If the closing bid price of our common stock on the Nasdaq Global Market reaches a minimum of $1.00 per share and remains at or above that level for a minimum of ten consecutive trading days (or longer, if required by the Nasdaq Listing Qualifications Panel), as discussed more fully below, our Board may decide to abandon the proposed amendment of the Amended and Restated Certificate of Incorporation in its entirety. Purpose and Overview of the Reverse Stock Split Our primary objective in effectuating the reverse stock split would be to attempt to raise the per-share trading price of our common stock to continue our listing on the Nasdaq Global Market. To maintain listing, the Nasdaq Global Market requires, among other things, that our common stock maintain a minimum closing bid price of $1.00 per share. On November 20, 2023, the closing price for our common stock on the Nasdaq Global Market was $0.4020 per share. TABLE OF CONTENTS On July 26, 2023, we received a deficiency letter from the Nasdaq Stock Market notifying the Company that, for the last 30 consecutive business days, the bid price for the Company’s common stock had closed below the minimum bid price for continued inclusion on the Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(a)(1) (the “minimum bid price rule”). In accordance with Nasdaq rules, the Company was provided an initial period of 180 calendar days, or until January 22, 2024, to regain compliance. Under the Nasdaq rules, companies may be eligible for an additional 180 calendar day compliance period but the Company is not presently eligible. If the Company does not regain compliance with the minimum bid price rule by January 22, 2024 and is not eligible for an additional compliance period, Nasdaq will provide written notification to the Company that its common stock may be delisted. Our Board is seeking stockholder approval of the Amendment Proposal in order to have the authority to effectuate the reverse stock split as a means of increasing the share price of our common stock at or above $1.00 per share in order to avoid further action by Nasdaq, in the event we are not able to satisfy the minimum bid price requirement in adequate time before the deadline. We expect that the reverse stock split would increase the bid price per share of our common stock above the $1.00 per share minimum price, thereby satisfying this listing requirement. However, there can be no assurance that the reverse stock split would have that effect, initially or in the future, or that it would enable us to maintain the listing of our common stock on the Nasdaq Global Market. The proposed reverse stock split is not intended to be an anti-takeover device. In addition, we believe that the low per-share market price of our common stock impairs its marketability to, and acceptance by, institutional investors and other members of the investing public and creates a negative impression of the Company. Theoretically, decreasing the number of shares of our common stock outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be interested in acquiring them or our reputation in the financial community. In practice, however, many investors, brokerage firms and market makers consider low-priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower-priced stocks. The presence of these factors may be adversely affecting, and may continue to adversely affect, not only the price of our common stock but also its trading liquidity. In addition, these factors may affect our ability to raise additional capital through the sale of our common stock. We also believe that a higher stock price could help us attract and retain employees and other service providers. We believe that some potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the company’s market capitalization. If the reverse stock split successfully increases the per-share price of our common stock, we believe this increase would enhance our ability to attract and retain employees and service providers. Further, the reverse stock split will result in additional authorized and unissued shares becoming available for general corporate purposes as the Board may determine from time to time, including for use under its equity compensation plans. We believe that the decrease in the number of shares of our outstanding common stock because of the reverse stock split, and the anticipated increase in the price per share, would possibly promote greater liquidity for our stockholders with respect to their shares. However, liquidity may be adversely affected by the reduced number of shares that would be outstanding if the reverse stock split is effected, particularly if the price per share of our common stock begins a declining trend after the reverse stock split is effectuated. There can be no assurance that the reverse stock split would achieve any of the desired results. There also can be no assurance that the price per share of our common stock immediately after the reverse stock split would increase proportionately with the reverse stock split, or that any increase would be sustained for any period of time. We believe the reverse stock split is the most likely way to assist the stock price in reaching the minimum bid level required by the Nasdaq Global Market, although effecting the reverse stock split cannot guarantee that we would be in compliance with the minimum bid price requirement for even the minimum ten-day trading period required by the Nasdaq Global Market. Furthermore, the reverse stock split cannot guarantee we would be in compliance with the market capitalization, net worth or stockholders’ equity criteria required to maintain our listing on the Nasdaq Global Market. If our stockholders do not approve the Amendment Proposal and our stock price does not otherwise increase to greater than $1.00 per share for an least ten consecutive trading days before January 22, 2024 (or before the end of an extended compliance period, if granted), we expect our common stock to be subject to a delisting action by Nasdaq. TABLE OF CONTENTS If our common stock were delisted from the Nasdaq Global Market, trading of our common stock would thereafter be conducted on the OTC Bulletin Board or the “pink sheets.” As a result, an investor may find it more difficult to dispose of, or to obtain accurate quotations as to the price of, our common stock. To relist shares of our common stock on the Nasdaq Global Market, we would be required to meet the initial listing requirements for the Nasdaq Global Market, which are more stringent than the maintenance requirements. If our common stock were delisted from the Nasdaq Global Market and the price of our common stock were below $5.00 at such time, such stock would come within the definition of “penny stock” as defined in the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and would be covered by Rule 15g-9 of the Exchange Act. That rule imposes additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5 million or individuals with net worth in excess of $1 million or annual income exceeding $200,000 or $300,000 jointly with their spouse). For transactions covered by Rule 15g-9, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. These additional sales practice restrictions would make trading in our common stock more difficult and the market less efficient. In evaluating whether to seek stockholder approval of the Amendment Proposal, our Board took into consideration negative factors associated with reverse stock splits. These factors include: the negative perception of reverse stock splits that investors, analysts and other stock market participants may hold; the fact that the stock prices of some companies that have effected reverse stock splits have subsequently declined, sometimes significantly, following their reverse stock splits; the possible adverse effect on liquidity that a reduced number of outstanding shares could cause; and the costs associated with implementing a reverse stock split. Even if our stockholders approve the Amendment Proposal, our Board reserves the right not to effect the proposed amendment in its entirety if in our Board’s opinion it would not be in the best interests of the Company or our stockholders to effect a reverse stock split. Risks Associated with the Reverse Stock Split We cannot predict whether the reverse stock split, if completed, will increase the market price for our common stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that: the market price per share would either exceed or remain in excess of the $1.00 minimum bid price per share as required to maintain the listing of our common stock on the Nasdaq Global Market; we would otherwise meet the requirements for continued listing of our common stock on the Nasdaq Global Market; the market price per share of our common stock after the reverse stock split would rise in proportion to the reduction in the number of shares outstanding before the reverse stock split; the reverse stock split would result in a per-share price that would attract brokers and investors who do not trade in lower-priced stocks; the reverse stock split would result in a per-share price that would increase our ability to attract and retain employees and other service providers; or the reverse stock split would promote greater liquidity for our stockholders with respect to their shares. In addition, the reverse stock split would reduce the number of outstanding shares of our common stock without reducing the number of shares of available but unissued common stock, increasing the number of authorized but unissued shares of common stock. Therefore, the number of shares of our common stock that are authorized and unissued will increase relative to the number of issued and outstanding shares of our common stock following the reverse stock split. The Board may authorize the issuance of the remaining authorized and unissued shares without further stockholder action for a variety of purposes, except as such stockholder approval may be required in particular cases by our Amended and Restated Certificate of Incorporation, applicable law or the rules of any stock exchange on which our securities may then be listed. The issuance of additional shares would be dilutive to our existing stockholders and may cause a decline in the trading price of our common stock. The issuance of authorized but unissued shares of common stock could be used to deter a potential takeover of TABLE OF CONTENTS us that may otherwise be beneficial to stockholders by diluting the shares held by a potential suitor or issuing shares to a stockholder that will vote in accordance with the Board’s desires. A takeover may be beneficial to independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for their shares of stock compared to the then-existing market price. We do not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences. The market price of our common stock is based on our performance and director nominations dueother factors, some of which are unrelated to the number of shares outstanding. If the reverse stock split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a reverse stock split. Principal Effects of the Reverse Stock Split on the Market for next year’s Annual Meeting?Our Common Stock On November 20, 2023, the closing price for our common stock on the Nasdaq Global Market was $0.4020 per share. By decreasing the number of shares of our common stock outstanding without altering the aggregate economic interest represented by the shares, we believe the market price would be increased. The greater the market price rises above $1.00 per share, the less risk there would be that we would fail to meet the requirements for maintaining the listing of our common stock on the Nasdaq Global Market. However, there can be no assurance that the market price of the common stock would rise to or maintain any particular level or that we would at all times be able to meet the requirements for maintaining the listing of our common stock on the Nasdaq Global Market. Principal Effects of the Reverse Stock Split on Our Common Stock; No Fractional Shares If our stockholders approve the Amendment Proposal, and if our Board decides to effectuate a proposed amendment to effect a reverse stock split, the principal effect of the amendment would be to reduce the number of issued and outstanding shares of our common stock including those held by the Company in treasury stock, depending on the Split Ratio Range set forth in such amendment, from 44,384,684 shares as of the record date to between 1,268,133 shares and 4,438,468 shares. If the reverse stock split is effectuated, the total number of shares of our common stock each stockholder holds would be reclassified automatically into the number of shares of our common stock equal to the number of shares of our common stock each stockholder held immediately prior to the reverse stock split divided by the ratio approved by the Board within the Split Ratio Range and set forth in the applicable amendment. Effecting the reverse stock split will not change the total authorized number of shares of our common stock. However, the reduction in the issued and outstanding shares would provide more authorized shares available for future issuance. We have no specific plan, commitment, arrangement, understanding or agreement, either oral or written, regarding the issuance of common stock subsequent to this proposed increase in the number of authorized shares at this time, and we have not allocated any specific portion of the proposed increase in the authorized number of shares to any particular purpose. However, we have in the past conducted certain public and private offerings of our securities, and we will continue to require, and are actively seeking, additional capital in the near future to fund our operations. As a result, it is foreseeable that we will seek to issue such additional shares of common stock in connection with any such capital raising activities, or any of the other activities described above. The Board does not intend to issue any common stock or securities convertible into common stock except on terms that the Board deems to be in the best interests of us and our stockholders. The reverse stock split would affect all of our stockholders uniformly and would not affect any stockholder’s percentage ownership interests, except to the extent that the reverse stock split results in such stockholder owning a fractional share. No fractional shares will be issued in connection with the reverse stock split. Stockholders who otherwise would be entitled to receive fractional shares because they hold a number of pre-split shares not evenly divisible by the number of pre-split shares for which each post-split share is to be exchanged, will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing price of the common stock, as reported by Nasdaq, on the last trading day prior to the effective date of the split. The proceeds would be subject to certain taxes as discussed below. In addition, stockholders would not be entitled to receive interest for the period of time between the filing of the certificate of amendment to the Amended and Restated Certificate of Incorporation and the date a stockholder receives payment for the cashed-out shares. The payment amount would be paid to the stockholder in the form of a check in accordance with the procedures outlined below. TABLE OF CONTENTS After the reverse stock split, a stockholder would have no further interest in the Company with respect to such stockholder’s cashed-out fractional shares. A person otherwise entitled to a fractional interest would not have any voting, dividend or other rights except to receive payment as described above. Principal Effects of the Reverse Stock Split on Outstanding Equity As of the record date, we had outstanding (a) options to purchase an aggregate of 5,058,045 shares of our common stock with exercise prices ranging from $0.261 to $17.25 per share and (b) 186,296 restricted stock units outstanding (including performance-based restricted stock units at target). Under the terms of the stock options, when the reverse stock split becomes effective, the number of shares of our common stock covered by each of them would be divided by the number of shares being combined into one share of our common stock in the reverse stock split and the exercise or conversion price per share would be increased to a dollar amount equal to the current exercise or conversion price, multiplied by the number of shares being combined into one share of our common stock in the reverse stock split. This results in the same aggregate price being required to be paid upon exercise as was required immediately preceding the reverse stock split. The number of shares reserved under our option plan would decrease by the ratio approved by the Board within the Split Ratio Range. Outstanding restricted stock units will also be proportionally adjusted by the ratio approved by the Board within the Split Ratio Range. Principal Effects of the Reverse Stock Split on Legal Ability to Pay Dividends We have not declared or paid any dividends on our common stock, nor do we have any plans to declare in the foreseeable future any distributions of cash or other property to holders of common stock, and we are not in arrears on any dividends. Therefore, we do not believe that the reverse stock split would have any effect with respect to future distributions, if any, to holders of our common stock. Accounting Matters The reverse stock split would not affect the par value of our common stock, which would remain unchanged at $0.001 per share. As a result, on the effective date of the reverse stock split, the stated capital on our balance sheet attributable to our common stock would be reduced by the ratio approved by the Board within the Split Ratio Range. In other words, stated capital would be reduced by the ratio approved by the Board within the Split Ratio Range, and the additional paid-in capital account would be credited with the amount by which the stated capital is reduced. The per-share net income or loss and net book value of our common stock would be increased because there would be fewer shares of our common stock outstanding. Beneficial Holders of Our Common Stock (Stockholders Who Hold in “Street Name”) Upon the reverse stock split, we intend to treat shares held by stockholders in “street name,” through a broker, in the same manner as registered stockholders whose shares are registered in their names. Brokers would be instructed to effect the reverse stock split for their beneficial holders holding our common stock in “street name.” However, brokers may have different procedures than registered stockholders for processing the reverse stock split and making payment for fractional shares. Stockholders holding shares of our common stock with a broker and having any questions in this regard should contact their broker. Registered “Book-Entry” Holders of Our Common Stock If a stockholder holds registered shares in book-entry form with the transfer agent, no action needs to be taken to receive post-reverse stock split shares or cash payment in lieu of any fractional share interest, if applicable. If such a stockholder is entitled to post-reverse stock split shares, a transaction statement would automatically be sent to such stockholder’s address of record indicating the number of shares of our common stock held following the reverse stock split. If such a stockholder is entitled to a payment in lieu of any fractional share interest, a check would be mailed to the stockholder’s registered address as soon as practicable after the effective time of the reverse stock split. By signing and cashing the check, stockholders would warrant that they owned the shares of our common stock for which they received a cash payment. The cash payment is subject to applicable federal and state income tax and state abandoned property laws. No stockholders would be entitled to receive interest for the period of time between the effective time of the reverse stock split and the date payment is received. TABLE OF CONTENTS No Dissenters’ Rights Under the Delaware General Corporation Law, stockholders are not entitled to dissenters’ rights with respect to the reverse stock split. Material Federal Income Tax Consequences of the Reverse Stock Split The following summary describes certain material U.S. federal income tax consequences of the reverse stock split to holders of our common stock. For purposes of this summary a “non-U.S. holder” is any beneficial owner of our common stock that is not a “U.S. holder.” A “U.S. holder” is any of the following: an individual who is or is treated as a citizen or resident of the United States; a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized under the laws of the United States, any state thereof or the District of Columbia; an estate the income of which is subject to U.S. federal income taxation regardless of its source; or a trust (i) if a court within the United States is able to exercise primary supervision over the administration of such trust and one or more “United States Persons” have the authority to control all substantial decisions of such trust or (ii) that has a valid election in effect to be treated as “United States Persons” for U.S. federal income tax purposes. This summary does not address all of the tax consequences that may be relevant to any particular stockholder, including tax considerations that arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by stockholders. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our common stock as part of a position in a “straddle” or as part of a “hedging,” “conversion” or other integrated investment transaction for federal income tax purposes, or (iii) persons that do not hold our common stock as “capital assets” (generally, property held for investment). This summary is based on the provisions of the Code, U.S. Treasury regulations, administrative rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the reverse stock split. EACH STOCKHOLDER SHOULD CONSULT ITS OWN TAX ADVISOR REGARDING THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT. If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our common stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the reverse stock split. U.S. Holders The reverse stock split should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, except as described below with respect to cash in lieu of fractional shares, no gain or loss will be recognized upon the reverse stock split. In addition, the aggregate tax basis in the common stock received pursuant to the reverse stock split should equal the aggregate tax basis in the common stock surrendered (excluding the portion of the tax basis that is allocable to any fractional share), and the holding period for the common stock received should include the holding period for the common stock surrendered. A U.S. holder that receives cash in lieu of a fractional share of common stock in the reverse stock split generally will be treated as having received such fractional share and then as having received such cash in TABLE OF CONTENTS redemption of such fractional share interest. A U.S. holder generally will recognize gain or loss measured by the difference between the amount of cash received and the portion of the basis of the pre-reverse stock split common stock allocable to such fractional interest. Such gain or loss generally will constitute capital gain or loss and will be long-term capital gain or loss if the U.S. holder’s holding period in our common stock surrendered in the reverse stock split was greater than one year as of the date of the exchange. U.S. Information Reporting and Backup Withholding Information returns generally will be required to be filed with the Internal Revenue Service (“IRS”) with respect to the receipt of cash in lieu of a fractional share of our common stock pursuant to the reverse stock split in the case of certain U.S. holders. In addition, U.S. holders may be subject to a backup withholding tax at the rate specified in the Code on the payment of such cash if they do not provide their taxpayer identification numbers in the manner required or otherwise fail to comply with applicable backup withholding tax rules. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded or allowed as a credit against the U.S. holder’s federal income tax liability, if any, provided the required information is timely furnished to the IRS. Non-U.S. Holders Generally, non-U.S. holders will not recognize any gain or loss upon completion of the reverse stock split. In particular, gain or loss will not be recognized with respect to cash received in lieu of a fractional share provided that (a) such gain or loss is not effectively connected with the conduct of a trade or business in the United States (or, if certain income tax treaties apply, is not attributable to a non-U.S. holder’s permanent establishment or fixed base in the United States), (b) with respect to non-U.S. holders who are individuals, such non-U.S. holders are present in the United States for less than 183 days in the taxable year of the reverse stock split and other conditions are met, and (c) such non-U.S. holders comply with certain certification requirements. U.S. Information Reporting and Backup Withholding Tax In general, backup withholding and information reporting will not apply to payments of cash in lieu of a fractional share of our common stock to a non-U.S. holder pursuant to the reverse stock split if the non-U.S. holder certifies under penalties of perjury that it is a non-U.S. holder and the applicable withholding agent does not have actual knowledge to the contrary. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded or allowed as a credit against the non-U.S. holder’s U.S. federal income tax liability, if any, provided that certain required information is timely furnished to the IRS. In certain circumstances the amount of cash paid to a non-U.S. holder in lieu of a fractional share of our common stock, the name and address of the beneficial owner and the amount, if any, of tax withheld may be reported to the IRS. Recommendation of our Board OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK (WITHOUT REDUCING THE AUTHORIZED NUMBER OF SHARES OF OUR COMMON STOCK), IF AND WHEN DETERMINED BY OUR BOARD. TABLE OF CONTENTS

APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING TO A LATER DATE OR DATES, IF NECESSARY, TO PERMIT FURTHER SOLICITATION AND VOTE OF PROXIES IN THE EVENT THERE ARE NOT SUFFICIENT VOTES IN FAVOR OF THE AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT Background of and Rationale for the Adjournment Proposal If, at the Special Meeting, the number of shares of our common stock present or represented and voting in favor of the Amendment Proposal is insufficient to approve such proposal, the Chief Executive Officer or the Chairman of the Board of the Company, in his reasonable discretion, may move to adjourn the Special Meeting in order to enable our Board to continue to solicit additional proxies in favor of the Amendment Proposal. Our Board believes that if the number of shares of our common stock cast at the Special Meeting is insufficient to approve the Amendment Proposal, it is in the best interests of our stockholders to enable our Board to continue to seek to obtain a sufficient number of additional votes to approve the Amendment Proposal. In the Adjournment Proposal, we are asking stockholders to authorize the holder of any proxy solicited by our Board to vote in favor of adjourning or postponing the Special Meeting or any adjournment or postponement thereof. If our stockholders approve this proposal, we could adjourn or postpone the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time to solicit additional proxies in favor of the Amendment Proposal. Additionally, approval of the Adjournment Proposal could mean that, in the event we receive proxies indicating that a majority of the votes cast on the Amendment Proposal vote against the Amendment Proposal, we could adjourn or postpone the Special Meeting without a vote on the Amendment Proposal and use the additional time to solicit the holders of those shares to change their vote in favor of the Amendment Proposal. Recommendation of our Board OUR BOARD UNANIMOUSLY RECOMMENDS

A VOTE “FOR” APPROVAL OF THE ADJOURNMENT PROPOSAL. TABLE OF CONTENTS SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table sets forth certain information regarding the ownership of the Company’s common stock as of November 20, 2023 by: (i) each of our directors and named executive officers; (ii) all executive officers and directors of the Company as a group; and (iii) all those known by the Company to be beneficial owners of more than five percent of its common stock. Beneficial ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power of that security, including options and warrants that are currently exercisable or exercisable within 60 days of November 20, 2023, or issuable upon settlement of restricted stock units within 60 days of November 20, 2023. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting and investment power with respect to all shares of common stock shown that they beneficially own, subject to community property laws where applicable. Common stock subject to stock options currently exercisable or exercisable within 60 days of November 20, 2023, or issuable upon settlement of restricted stock units within 60 days of November 20, 2023, is deemed to be outstanding for computing the percentage ownership of the person holding these options and the percentage ownership of any group of which the holder is a member but is not deemed outstanding for computing the percentage of any other person. Our calculation of the percentage of beneficial ownership is based on 44,384,684 shares of our common stock outstanding on November 20, 2023. Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Eiger BioPharmaceuticals, Inc., 2155 Park Blvd., Palo Alto, CA 94306. 5% Stockholders:

| | | | | | | Entities affiliated with Ameriprise Financial, Inc.(2)

| | | | | | | 45 Ameriprise Financial Center

| | | | | | | Minneapolis, MN 55474 | | | 8,028,922 | | | 18.09% | Entities affiliated with Propel Bio Partners LLC(3)

| | | | | | | 1900 Avenue of the Stars, #1000

| | | | | | | Los Angeles, CA 90067 | | | 5,375,225 | | | 12.11% | Moshe Arkin(4)

| | | | | | | 6 Ha’Choshlim St., Building C, 6th Floor

| | | | | | | Herzliya Pituach 46724

| | | | | | | Israel | | | 4,481,126 | | | 10.09% | Entities affiliated with 683 Capital Management, LLC(5)

| | | | | | | 1700 Broadway, Suite 4200

| | | | | | | New York, NY 100193 | | | 3,115,000 | | | 7.02% | Named Executive Officers and Directors:

| | | | | | | David Apelian, M.D., Ph.D.(6) | | | 629,250 | | | 1.40% | Eldon Mayer(7) | | | 303,992 | | | * | David Cory(8) | | | 179,135 | | | * | Sriram Ryali(9) | | | 21,425 | | | * | Thomas Dietz, Ph.D.(10) | | | 223,000 | | | * | Jeffrey Glenn, M.D., Ph.D.(11) | | | 455,879 | | | 1.02% | Lisa Kelly-Croswell(12) | | | 15,000 | | | * | Evan Loh, M.D.(13) | | | 91,000 | | | * | Christine Murray, M.S., R.A.C.(14) | | | 78,000 | | | * | Kim Sablich, M.B.A.(15) | | | 40,222 | | | * | Amit Sachdev, J.D.(16) | | | 73,000 | | | * | All current executive officers and directors as a group (11 persons)(17) | | | 1,931,843 | | | 4.22% |

(1)

| This table is based upon information supplied by officers, directors and certain principal stockholders, Forms 4 and Schedules 13D and 13G filed with the SEC. |

(2)

| The indicated ownership is based solely on a Schedule 13G/A filed with the SEC by the reporting entities on April 10, 2023. The Schedule 13G/A provides information as of February 28, 2023. Of the 8,028,922 shares of common stock reported as beneficially |

TABLE OF CONTENTS owned by Ameriprise Financial, Inc. (“Ameriprise”), Ameriprise has shared voting power with respect to 7,283,215 shares and shared dispositive power with respect to 8,028,922 shares of common stock. Ameriprise, as the parent company of Columbia Management Investment Advisers, LLC (“CMIA”) may be deemed to have, but disclaims, beneficial ownership of the shares reported by Columbia in the Schedule 13G/A filing. Accordingly, the shares reported as beneficially owned by Ameriprise include those shares separately reported as beneficially owned by CMIA in the Schedule 13G/A filing. CMIA, as the investment adviser to Columbia Seligman Technology and Information Fund and Seligman Tech Spectrum (Master) Fund (collectively, the “Funds”) and various other unregistered and registered investment companies and other managed accounts, may be deemed to have, but disclaims, beneficial ownership of the shares reported by the Funds. Accordingly, the shares reported as beneficially owned by CMIA include those shares separately reported by the Funds in the Schedule 13G/A filing. (3)

| The indicated ownership is based solely on a Schedule 13D/A filed with the SEC by the reporting entities on November 3, 2023. The Schedule 13D/A provides information as of November 2, 2023. Of the 5,375,225 shares of common stock reported as beneficially owned by entities affiliated with Propel Bio Partners LLC (“Propel General Partner”), (i) Mr. Richard Kayne has shared voting and dispositive power over 5,375,225 shares; (ii) Propel Bio Management LLC (“Propel Management” and, with Propel General Partner, “Propel”) and Leen Kawas have shared voting and dispositive power over 4,391,432 shares; and (iii) the Richard Kayne and Suzanne Kayne Living Trust dtd 01/14/1999 (the “Family Trust”), of which Mr. Kayne serves as the trustee and a beneficiary, directly owns 983,793 shares, over which it has shared voting and dispositive power. Propel Management and Propel General Partner act as the investment advisor to one or more private investment funds and Propel Management acts as the investment advisor to an investment company registered under the Investment Company Act of 1940, as amended, and such investment funds and investment company directly owned the reported shares. Ms. Kawas and Mr. Kayne are co-founders of Propel and Ms. Kawas is the managing general partner thereof. Mr. Kayne, as trustee of the Family Trust, possesses voting control and/or power to direct the disposition of the shares held by the Family Trust. Accordingly, for purposes of Rule 13d-3 of the Exchange Act, the Family Trust and Mr. Kayne may be deemed to beneficially own such shares. Ms. Kawas is the sole owner of Propel Management. Propel General Partner, Propel Management, Ms. Kawas, Mr. Kayne and the Family Trust disclaim beneficial ownership of any shares not directly owned thereby. |

(4)

| The indicated ownership is based solely on a Schedule 13D/A filed with the SEC by the reporting person on December 4, 2023. The Schedule 13D/A provides information as of November 14, 2023. Moshe Arkin has sole voting power with respect to 4,481,126 shares and sole dispositive power with respect to 4,481,126 shares. |

(5)

| The indicated ownership is based solely on a Schedule 13G/A filed with the SEC by the reporting entities on February 14, 2023. The Schedule 13G/A provides information as of December 31, 2022. 683 Capital Management, LLC (“683 CM LLC”), 683 Capital Partners, LP (“683 CP LP”) and Ari Zweiman 683 CP LP and Ari Zweiman reported share voting and dispositive power with respect to 3,115,000 shares. 683 CM LLC, as the investment manager of 683 CP LP, may be deemed to beneficially own the 3,115,000 shares beneficially owned by 683 CP LP. Ari Zweiman, as the Managing Member of 683 CM LLC, may be deemed to beneficially own the 3,115,000 shares beneficially owned by 683 CM LLC. |

(6)

| Includes 11,000 shares owned directly by Dr. Apelian and 618,250 shares that Dr. Apelian has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options or issuable upon settlement of restricted stock units. |

(7)

| Includes 41,448 shares owned directly by Mr. Mayer and 247,919 shares that Mr. Mayer has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options or issuable upon settlement of restricted stock units. |

(8)

| Shares owned directly by Mr. Cory. |

(9)

| Shares owned directly by Mr. Ryali. |

(10)

| Includes 21,000 shares directly owned by Dr. Dietz and 152,000 shares that Dr. Dietz has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options or issuable upon settlement of restricted stock units and 50,000 shares held by the Dietz Family Trust. As a co-trustee of the Dietz Family Trust, Dr. Dietz shares voting and dispositive power over the shares held by the Dietz Family Trust. |

(11)

| Includes 182,355 shares owned directly by Dr. Glenn, 5,460 shares owned by immediate family members of Dr. Glenn, 117,000 shares that Dr. Glenn has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options or issuable upon settlement of restricted stock units and 151,064 shares held by Eiger Group International, Inc. Dr. Glenn is the Chief Executive Officer of Eiger Group International, Inc. Dr. Glenn has sole power to vote and sole power to dispose of shares directly owned by Eiger Group International, Inc. The address for Eiger Group International, Inc. is 2061 Webster Street, Palo Alto, CA 94301. |

(12)

| Includes 15,000 shares that Ms. Kelly-Croswell has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options. |

(13)

| Includes 14,000 shares owned directly by Dr. Loh and 77,000 shares that Dr. Loh has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options or issuable upon settlement of restricted stock units. |

(14)

| Includes 11,000 shares directly owned by Ms. Murray and 67,000 shares that Ms. Murray has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options or issuable upon settlement of restricted stock units. |

(15)

| Includes 6,000 shares directly owned by Ms. Sablich and 34,222 shares that Ms. Sablich has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options. |

(16)

| Includes 16,000 shares directly owned by Mr. Sachdev and 57,000 shares that Mr. Sachdev has the right to acquire from the Company within 60 days of November 20, 2023 pursuant to the exercise of stock options or issuable upon settlement of restricted stock units. |

(17)

| Includes only current directors and executive officers serving in such capacity on the date of the table: Dr. Apelian, Mr. Kachioff, Mr. Mayer, Mr. Vollins, Dr. Dietz, Dr. Glenn, Ms. Kelly-Croswell, Dr. Loh, Ms. Murray, Ms. Sablich and Mr. Sachdev. |

TABLE OF CONTENTS Householding of Proxy Materials The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements, annual reports and notices of internet availability of proxy materials with respect to two or more stockholders sharing the same address by delivering a single copy of the applicable document(s) addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. Brokers with account holders who are stockholders of the Company may be “householding” our proxy materials. A single proxy statement or notice may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you notify your broker or the Company that you no longer wish to participate in “householding.” If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement, annual report or notice you may (1) notify your broker, or (2) direct your written request to: Corporate Secretary, Eiger BioPharmaceuticals, Inc., 2155 Park Blvd., Palo Alto, CA 94306 or contact Mr. Vollins at 650-272-6138. Stockholders who currently receive multiple copies of our proxy statement and/or notice at their address and would like to request “householding” of their communications should contact their broker. In addition, the Company will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the proxy statement, annual report and/or notice to a stockholder at a shared address to which a single copy of the document(s) was delivered. Stockholder Proposals and Nominations To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 30, 202228, 2023 to Eiger’s Corporate Secretary at 2155 Park Blvd., Palo Alto, California 94306. If you wish to submit a proposal (including a director nomination) at the meeting that is not to be included in next year’s proxy materials, you must provide specified information in writing to our Corporate Secretary at the address above no earlier than February 16, 2023,2024, and no later than March 18, 2023;17, 2024; provided, however, that if our 20232024 Annual Meeting of Stockholders is held before May 17, 2023,16, 2024, or after July 16, 2023,15, 2024, notice by the stockholder to be timely must be received not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. You are also advised to review the Company’s Bylaws which contain additional requirements about advance notice of stockholder proposals and director nominations. In addition to satisfying the foregoing requirements and those under our Bylaws, to comply with the universal proxy rules (once effective), stockholders who intend to solicit proxies in support of director nominees other than management’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act, of 1934, as amended, or the “Exchange Act,” no later than April 17, 2023.How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count each proposal as follows:

16, 2024.For Proposal 1, the proposal to elect directors, votes “For” and “Withhold” will be counted for each nominee. Broker non-votes will not be counted towards the vote total for the nominee.

Annual Report4

For Proposal 2, to approve on an advisory basis the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, “For” and “Against” and abstentions will be counted, with abstentions having the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards this proposal.

For Proposal 3, to ratify they selection by the Audit CommitteeA copy of our Board of Directors of KPMG LLP as our independent registered public accounting firm, “For” and “Against” and abstentions will be counted, with abstentions having the same effect as “Against” votes.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by applicable stock exchange rules to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

| | | | | | | | | Proposal

Number

| | Proposal Description

| | Vote Required for Approval

| | Effect of Abstentions

| | Effect of Broker

Non-Votes

| 1 | | Election of Directors | | Nominees receiving the most “For” votes | | No effect | | No effect(1) | | | | | | 2 | | Approval on an advisory basis of the compensation of the Company’s named executive officers | | “For” votes from the holders of a majority of shares present virtually or represented by proxy and entitled to vote on the matter | | Against | | No effect | | | | | | 3 | | Ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | | “For” votes from the holders of a majority of shares present virtually or represented by proxy and entitled to vote on the matter | | Against | | Not applicable(2) |

(1) | While “Withhold” votes and broker non-votes will have no effect on the outcome of the vote, we have adopted a Director Resignation Policy pursuant to which any nominee for director at the Annual Meeting would be required to submit an offer of resignation for consideration by the Nominating and Governance Committee if such nominee for director receives a greater number of “Withhold” votes in respect of his or her election than votes “For” such election. For more information on this policy see the section titled “Information Regarding the Board of Directors and Corporate Governance—Director Resignation Policy.”

|

(2) | This proposal is considered to be a “routine” matter under NYSE rules. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority under NYSE rules to vote your shares on this proposal.

|

How does the Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote “For” the election of the nominees for director in Proposal 1; “For” the advisory approval of named executive officer compensation and “For” the ratification of the selection by the Audit Committee of the Board of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

5

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting virtually or represented by proxy. On the record date, there were 43,216,126shares outstanding and entitled to vote. Thus, the holders of 21,608,064 shares must be present virtually or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting virtually or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current reportReport on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the internet?

The Proxy Statement, Form 10-K and Annual Report to stockholders are available at www.proxyvote.com.

All references to “Eiger,” “we,” “us” or “our” in this Proxy Statement mean Eiger BioPharmaceuticals, Inc., the combined company.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

Our Board of Directors currently has eight members. There are three directors in the class whose term of office expires in 2022: David A. Cory, R.Ph., M.B.A., David Apelian, M.D., Ph.D., M.B.A., and Christine Murray, M.S., R.A.C., each of whom is a nominee for director and currently a director of the Company. Based on the recommendation of the Nominating and Governance Committee, the Board nominated each of the three nominees for reelection. David A. Cory was elected to the Board prior to the completion of the Merger. David Apelian was appointed to the Board in June of 2017 and Christine Murray was appointed to the Board in January of 2019, each to serve as a Class I director. If elected at the Annual Meeting, each of the Class I nominees would serve until the 2025 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal.

It is the Company’s policy to invite and encourage directors and nominees for director to attend the Annual Meeting. All directors attended the 2021 Annual Meeting.

Directors are elected by a plurality of the votes of the holders of shares present virtually or represented by proxy and entitled to vote on the election of directors. Accordingly, the nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. If the nominees become unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by Eiger. Each person nominated for election has agreed to serve if elected. The Company’s management has no reason to believe that any nominee will be unable to serve.